2022 thesis

speculation on the new year.

So, here we are.

A new year, a new you (maybe), a new market, and a new chance to win big or lose big.

I will try to keep this short and simple as there is much to cover.

Let’s begin.

introduction

First, a bit of background of what we are transitioning from.

Last year should have been quite interesting for anyone situated in the cryptocurrency space. Parabolic price action followed by violent crashes giving you multiple possibilities of dumping your bags on a plethora of new boomer entrants, celebrities, or more of the same not so knowledgeable degens. Adoption continued to grow at an astounding pace, exceding many expectations of even the most optimistic. All this was followed closely by an introduction of increased regulatory framework and the introduction of the first bitcoin etf (not spot tho).

This past year was quite special compared to all the rest though.

It was a year that can be defined above all and very simply as, redarded.

Some examples:

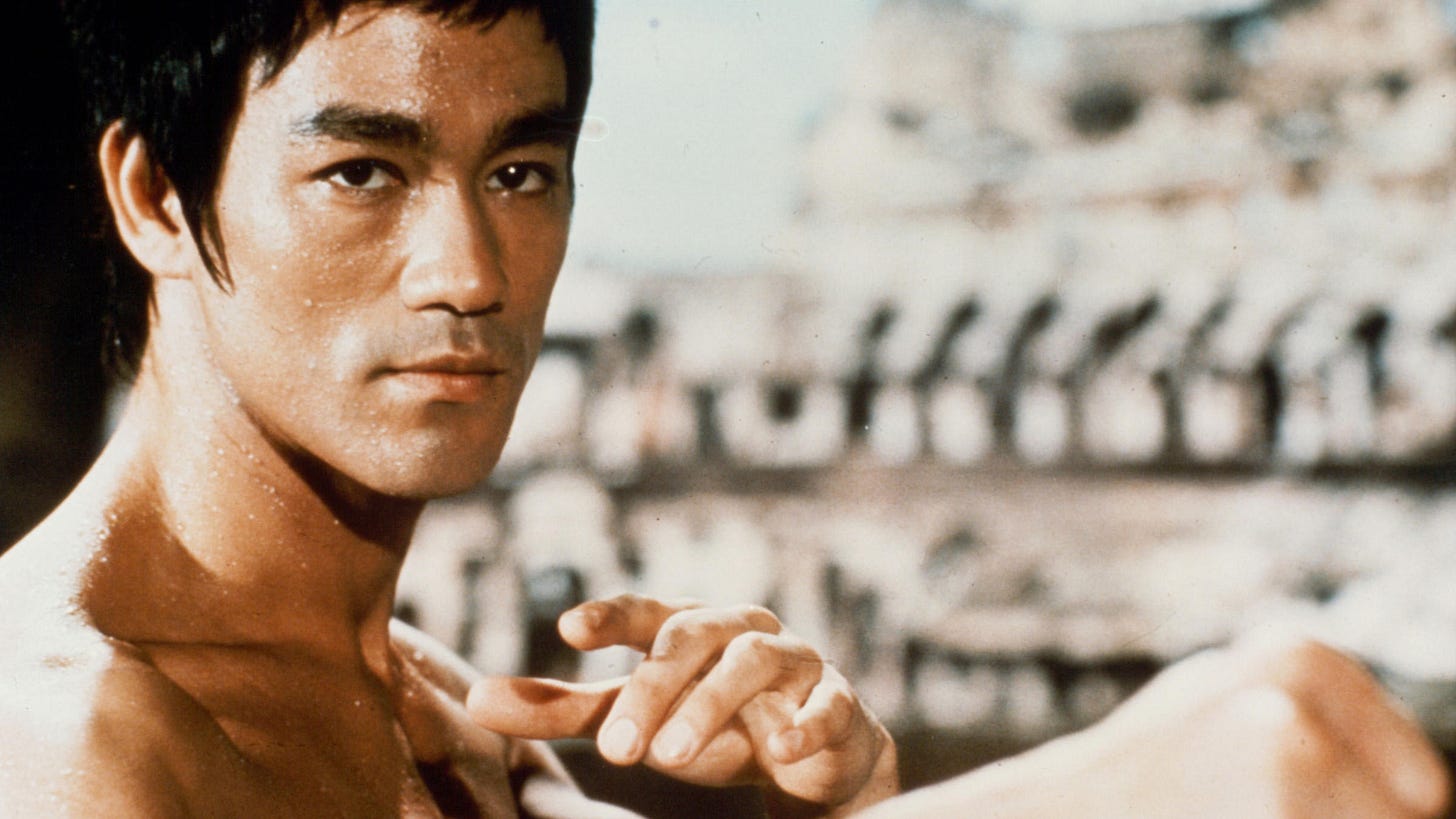

The man above taking out a truly innumerable amount of debt at a time that is unequivocally similar to that of previous tops in the broader market while continuing to get the worst possible fills in existence on what is still (albeit sadly) a completely speculative asset. People bidding millions of dollars on pictures of apes, only to reveal their seed phrase with ease to a smelly man squatting relentlessly in a room on the other side of the world. The richest man in the world shilling the true definiton of inflationary vaporware of a coin with a dog on it doing multiples over what you could even unreasonably think up of in your head. Then there was the other dog coin. I can continue, but I think you get the jist.

The somewhat sad part is, the lower the iq - the more you should have profit. Something that you should plan to take advantage of in every way possible this year if this trend persists.

In summary, although what happened last year may seem somewhat insane to any rational thinker. This shouldn’t come as a suprise by any means. We live in a world of irrationality, incessant greed, and the always prevalent need to act on impulse ushered by groupthink. The cherry on top being the special mostly subconscious desire to stay distracted and unaware of the important underlyings around us. This is a world now filled with more dunning-krugers than you can imajin.

A true feat for twenty-first century humanity.

This takes me to my main point. The one that you came here for.

2022 thesis

“If you can’t beat them, join them.”

Or shall I say, join the protocols that abuse them. (referring to the left of center)

With the steady rise of the option slinging, liquidity farming, jpeg buying and derivative dumping degens in this space - it only makes sense to follow the flow.

This leads into my thesis on why protocols with amazing ponzinomics focused on providing gambling as a service (GaaS - as I like to call it) built within a good ecosystem providing reasonable fees and a fluid user experience will do extremely well. Whether it be on Vitamins chain, the one that seems to get ddos’d often, or the countless other layer one’s or layer two’s, I don’t have a preference. But for now, the best projects I see making headway in this still somewhat niche intersection are on ethereum.

You will also need to have some protocols that provide different stables you can mess around with. There are many different options that I will breifly touch on below. Some are more resistant to certain vectors of attack than others, but all play a critical role in the further adoption of this space and the continuous ushering out of the outdated and broken one.

[insert - my bags]

For those that don’t already know. These are just tetra’s bags.

If there was one thing I became absolutely certain of last year, it’s that you never fade tetranode, his good friend dani, and ansem. You will regret it ten times out of ten.

Because I am keeping this short and sweet I am not going to get into all the bullish technicals of these projects.

Ok, maybe I will.

[those ponzis]

Curve: You know what liquidity pools are, right anon? If you don’t you should and if you do, then you already know what curve is. Plus, their logo is the sexiest thing I have ever seen in a protocol. Enough said, next.

Convex: They own the majority of Curve and decide which pools the rewards and therefore the liquidity gets directed to. These guys are the ones that initiated something called the “Curve Wars.” Probably don’t want to fade a team that started such a beautiful symbiotic war in defi with a super dope(x) name.

Dopex: If you want to bet on the success or price change of the liquidity pools, coins, and much else among all things defi with options then you will want to will most likely use this. (Bonus) They are constantly thinking of new ideas to implement to make it more degen, like 1000x on the underlying.

Let me repeat, 1000x.

Absolutely beautiful for the likes of myself and the many other redards.

Ohm: You know about Turkey? Not that dry ass meat that burgers eat on thanksgiving, but that country near that area that was once known as a somewhat stable Europe Union? Yeah, so the central bank there is pretty much doing exactly what ohm created with bonding following the collapse of purchasing power of their native currency last year, the lira. Ohm is working towards being the defacto reserve currency of defi with superior ponzinomics. It is quite the goal, but one that they are getting closer to as time goes on than most would believe.

[Redacted]: Besides being another protocol with amazing name, they own a metric fuck ton of the supply of the coins I listed above and more that I will list below. This is another symbiotic protocol to the mix of all the those already mentioned. So if you are bullish on these ponzis, you are bullish on [redacted] - even if you don’t know it yet. Teamwork makes the dream work baby.

Tribe, Frax, and Spell: All these play a critical role in either the governance and/or backing of some of the main stablecoins that will be used within a large portion of defi to make things run smoothly, giving degens a sense of security, and to help bank the unbanked and debank the boomer banked. The workings of all of these are for another article.

(The ongoing discussion on which stables are superior is an extremely complex and interesting topic and one that will go on for a long time. The winners will only become apparent after everything is said and done, especially after regulations we all know are coming. Others include Dai, UST, USDC, TUSD, etc. and their respective protocols and/or backings.)

Rocket Pool: Do you have 32 eth and want to run a full node? Maybe? Probably not? Regardless, if you want to stake any amount of eth and earn rewards within a decentralised framework, this will help you out. Another similar project is Lido. I like both of them going forward albeit the former a little more than the latter.

JPEG’d: This one is for all you nft nerds. They are bringing defi to nft’s and you will have the option of taking out loans on your worthless pics so you can buy more worthless pics if you so please. In all seriousness, value is where value is sought and if you can make a living taking out loans while owning digital art, that is not a bad way to live by any means. Just don’t be racist and by an ape, kek.

(Some personal additions below)

Yearn: They post hentai and have a war chest of a dev team and their protocol is amazing as well. You probably know about them already as it is one of the few projects in this space that doesn’t need much of an introduction.

ily bantg.

Alchemix: Loans that repay themselves. Loans that repay themselves. Loans that repay themselves. This is simple wording for all types of the spectrum to understand and it may actually turn out to be one of the first protocols no-coiners try out due to precisely that. If there is demand for liquidity, take advantage.

Ribbon: A lesser known addition to the options world of defi. Allows you to generate yield via automated options strategies. So, if you like options and are terrible at math, but you know that number go up is addition and is good, then you will want to experiement with ribbon until you read up. Just don’t go to voltwit, whatever you do.

Sushi: One of the dani coins coming back from the dead. Everyone has been waiting for a fluid multichain dex and sushi may be just that in the near future. The tokenomics are also set as to benefit the investors much more than it’s immediate competition and fraternal older twin, uniswap.

All these protocols I think will gain adoption and token appreciaton over most of the new year as long as the market stays healthy. But, we know this space moves fast and it is incredibly hard to predict price action or really anything more than a month out, even that is a stretch most of the time.

layer one’s

In the grand scheme of things Ethereum is not that bad, especially now that many layer two solutions are finally starting to come alive and some of the popular protocols are already bridging over. With that being said, there are also plenty of other layer ones that have interesting implementations to combat pricing out retail with high fees, and keeping network uptime while also trying to optimize for decentralisation and security.

Eventually they will all have their own defi ponzis launching. This has the potential to spark a lot of opportunity in your portfolio and is what I will spend most of my time looking into this year.

The biggest reward this year will come from tons of research into ecosystem plays. Especially the ones that have to do with options, liquidity, and possibly anything with the word amm. Also, the nice thing about defi appreciation is that they always lag their respective native ecosystem token and right now one of the major narratives seems to be exactly that.

Wink, wink.

I am confident most of you reading this will be familiar with SoLunAvax, and now the new FOAN squad (Fantom, One, Atom, and Near) among the others not mentioned. Find the ones that outperform, the ones in which the teams deliver, and the ones that have healthy adoption on multiple metrics (tvl, unique wallets, active wallets, chain revenue, whatever you want.) Note your favorites and have conviction, but also play the wonderful game of rotating between the crosschain hype cycles. I will note I think the Layer ones that performed well last year will underperform this year for obvious reasons.

One that I am keeping an eye on for the time being is NEAR. You might agree if you have read their docs, and if you have an amazing friend that does a write up.

Thank you, Curious.

Another one will be Fantom. (again, don’t fade dani)

In general, the best thing you can do in this space is to have like-minded friends on a seperate discord or telegram where you can share ideas and spread out work load.

When you are following the momentum, just remember to stay open and fluid as the hype can be defi or gamefi or whatever else stupid shit crypto twitter can come up with in an instant. Your risk management needs to be immaculate as capital preservation is the only key to winning in a space where narratives can last a week, or less.

Remember, the market always rewards those that get their hands dirty, and those that flow like water. There is always tomorrow, but not if you lose it all.

multichain

Now to use all these different chains to extract as much value as possible, you will need a bridge to connect all of them. Pick your poison, but keep tabs on value bridged between all of the main ones, which ones are growing the fastest, etc. It’s pretty hard to fuck this one up, as it is beyond simple. The future will be multichain, but it might not be multibridge, may the best prevail.

Synapse is one that comes to mind for me. One of the first popularized that also has extrememly fluid ux, supported by some of the chadiest of chads in the space. Some of the same ones that helped bring you insilico terminal, helping you to limit some of your reliance on terrible exchanges.

Eventually, when you get overheated from trading and researching and want to take a break, but can’t because your addicted to this space, you can atleast pretend to fool yourself and play a fun game called Defi Kingdoms.

I will not be getting into the details of this as it has been all the hype the past couple weeks and many of you know it all too well and are probably bored of hearing about it. However, I am very much looking forward to following the first not so terrible blockchain game with amazing devs for the long run. I think there is an insane amount of upside in entertainment that brings cash flow so long as hype doesn’t die down completely, which is much less likely with this project compared to the others in my honest opinion. I tend to think it is extremely important to follow gaming trends in the future as it is taking over the world as an escape from the physical one that is becoming increasingly difficult to deal with for the majority of plebs out there.

residual macro views for the layman

Now to touch on the only thing that really matters.

Everything I mentioned above is all fun and games (literally). My thesis above is for a healthy market, but what does it really mean when ‘number go up’ on all of these coins is correlated with traditional markets, and what if those markets may not be as healthy as we think they are?

Inflation as we all know was not transitory in the way that ‘experts’ thought about it. A deflationary spiral can make it transitory for a short period of time, but that is besides the point right now, although it is still possible and something I am prepared for as a worst case scenario.

Continuing on, recent cpi prints are the highest they have been in decades and I am expecting them to get higher in the next couple of months as omicron continues to cause more hysteria and closes more of the supply chain and work force. Afterall, this is what happens when you print money. [insert m2 chart we all know and love.]

The middle class has no savings. Millenials in general can’t buy homes. Slightly over four million people quit their jobs in the US just in the month of November. The breadth of major indicies is just flabergasting at the moment as most of the small and mid cap stocks have already been decimated from ath’s. Retail is full send with all their net worth on what they think will help them ‘make it’. Legacy is not far behind, as there is no safe place to hide when the dumbed down herd is worried more about short term negative returns or retiring in one trade than long term capital protection. What happens when protests continue to break out worldwide and governments resort to limiting the internet to quell violence? Again, I can go on, but you get the jist.

People don’t want to work, they want to have fun and sling shitcoins with us.

Can you blame them?

On a serious note, how much longer can a world go on like this? I find myself pondering this everyday, being impartial as possible. At what point does the momentum break down, and are we not already seeing that right now? Maybe I am going against my thesis and underestimating irrationality, but at a certian point it’s time to call things for what they are, right?

The federal reserve is expected to hike rates at least a couple times in 2022 which is quite a bit more compared to the last two years. They are also starting to taper the assets they have been buying since the pandemic began while also unwinding the balance sheet. For those unaware, this tends to be catalyst for risk off behavior. Expect volatility to the downside (suprise!) in legacy, which as we all know affects the price our favorite shitcoins.

Bottom line is things don’t look nearly as good as they did the last couple years in terms of putting money into the broad scope of the markets.

There are many more substantial risks apparent that I will not get into. Just know what you are participating in is incredibly fragile.

Oh, and I haven’t even mentioned the regulations coming to this space.

(for another article)

conclusion

Egotistical predictions: this is final leg of bull run which ends sometime around q2 this year soon after breaking previous ath’s. It will be a swift and violent pump and most everyone will sell at the wrong time or be sidelined during most of the move just to become exit liquidity (thanks in advance). The alternative layer one and layer two narrative will die out relatively soon for this cycle, not so long before the top. Gamefi will become a crowded trade. Majors will suck the life out of most of your smaller holdings in a beautiful generational exit pump. There will be no alt season afterwords, just straight down initiated mostly by massive liquidations in legacy.

Max pain, eh?

In closing however, I would like to add that everything I wrote in the paragraph above is close to complete buffoonery and is only included so I can claim clout if it comes true, like everyone else that makes predicions. I am also not here to shill all of my bags, because that is doing a disservice to both you and me, and more importantly is a just fools errand. I let price speak for itself and don’t mess around with silly predictions as it is only a game between ones ego.

Just vibe.

After all of that I would like to leave you with one of my favorite quotes from last year which I think will have great merit going into this one.

“We can stay retarded longer than you can stay solvent.”